Is It Better To Emergency Fund Into Money Market Versus Bond Fund

QQQ from Invesco tracks the NASDAQ 100 Alphabetize. SPY from SPDR (and VOO from Vanguard) tracks the Due south&P 500. These are 2 very different funds that track very unlike indexes. I compare them hither.

Disclosure: Some of the links on this page are referral links. At no additional price to yous, if you choose to make a purchase or sign upwardly for a service after clicking through those links, I may receive a small commission. This allows me to go on producing high-quality, advertising-gratis content on this site and pays for the occasional cup of coffee. I have commencement-hand feel with every product or service I recommend, and I recommend them because I genuinely believe they are useful, non considering of the commission I get if yous decide to buy through my links. Read more here.

In a hurry? Hither are the highlights:

- QQQ and SPY are two very different funds.

- QQQ from Invesco tracks the NASDAQ 100 Index. SPY from SPDR tracks the S&P 500 Index.

- QQQ is 100 stocks in a handful of sectors, largely concentrated in tech. SPY is 500 stocks spread across all sectors.

- QQQ is already within SPY, comprising 42% by weight. SPY is already over 1/4 tech.

- QQQ is purely large cap growth stocks, which are looking extremely expensive relative to history, and fundamentals practise non explain their expensiveness.

- SPY is basically the aforementioned matter as VOO from Vanguard; they runway the same alphabetize.

- QQQ has a fee of 0.20%. SPY is cheaper at 0.09%. VOO is even cheaper at 0.03%.

- QQQ has beaten SPY in recent years, simply that doesn't mean it will continue to do so.

- QQQ should non supplant SPY as a cadre holding in a diversified portfolio.

Video

Prefer video? Watch information technology here:

QQQ vs. SPY (and VOO) – Methodology, Similarities, Differences, Stats, & More than

QQQ is an extremely popular fund from Invesco that seeks to runway the NASDAQ 100 Index. These are the 100 largest companies that trade on the NASDAQ commutation, excluding Financials. This index describes itself as companies "on the forefront of innovation."

Prominent holdings include names like Apple, Microsoft, Amazon, and Google. In fact, these iv names make up over 1/3 of QQQ. As such, it's basically a tech fund at this signal due to Large Tech making upwards such a huge chunk of the market by weight. Specifically, QQQ is over 63% tech at the time of writing.

QQQ launched in 1999. It has over $180 billion in assets and an average daily volume of over $12 billion. It costs 0.twenty%. QQQ has grown even more than in popularity over the past decade or so due to its market outperformance thanks to the stellar run by Big Tech. It also has a 3x leveraged cousin TQQQ, likewise as a new, cheaper little blood brother QQQM.

Now let's talk well-nigh SPY. It's the original ETF from SPDR; it launched in 1993. It costs 0.09%. SPY is still the largest, most traded fund out at that place, with over $380 billion in avails. It seeks to rails the famous S&P 500 Alphabetize, and it does a great job of doing so. These are the 500 largest companies in the United States. The Southward&P 500 is representative of U.S. large cap stocks, and is considered a barometer of the U.Due south. stock market as a whole.

VOO from Vanguard is basically the aforementioned thing every bit SPY except information technology'southward a bit cheaper (VOO costs 0.03%). Information technology tracks the same alphabetize. Thus, a comparison of QQQ and SPY is simultaneously a comparison of QQQ and VOO.

Again, given the contempo run of large cap growth stocks over the past decade, many novice investors (and sadly, experienced investors) take been flocking to QQQ, even letting it replace SPY or VOO as their cadre holding. Don't exercise that.

If you didn't already choice up on this fact, QQQ is not at all a well-diversified fund, and should not supplant a broad market index like the Due south&P 500 as a core property in a diversified portfolio. Once again, it's mostly tech companies; sectors like Utilities, Industrials, and Consumer Staples are all but absent from this fund.

QQQ is a highly concentrated basket of 100 companies in a handful of sectors. SPY is 500 companies across all sectors. Since Big Tech companies are indeed big, the tech sector now comprises over 1/iv of the S&P 500. Because of this, investors may not realize that the companies in QQQ comprise roughly 42% of the Southward&P 500 by weight. That is, QQQ is already within SPY. If you own the latter, you already own the former.

QQQ vs. SPY & VOO – Historical Performance

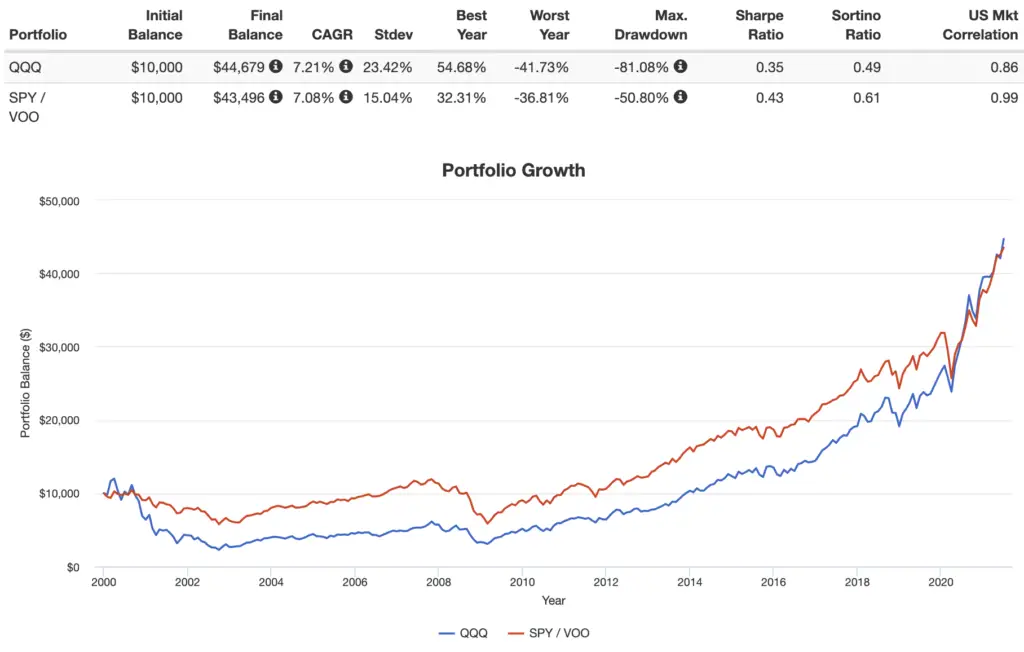

Let's talk about functioning. Hither's the history from 2000 through June, 2021:

QQQ and SPY have been cervix and neck at the end. Granted, QQQ had a crude commencement with the Dotcom crash. Yet, check out its much greater volatility and drawdown. SPY notwithstanding delivered a much greater take a chance-adjusted render.

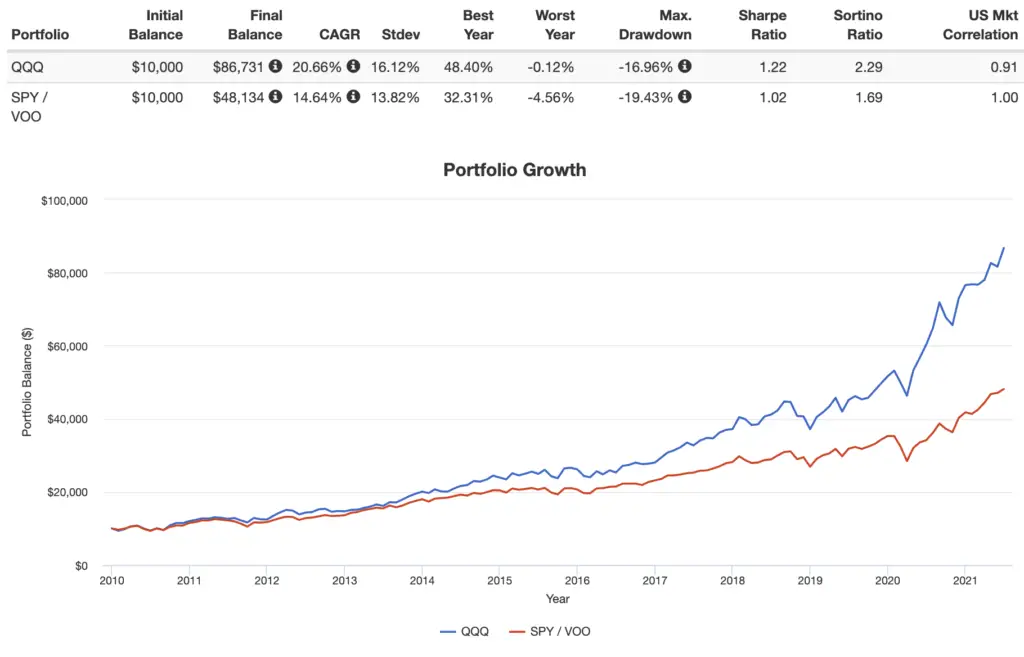

At present let'southward look at the past decade, showing why people accept flocked to this fund:

Looks smashing, right? Even though it yet exhibited greater volatility, QQQ even had a higher risk-adjusted return than the broader SPY. But don't go too excited. Again, we wouldn't await the next decade to look like the previous decade. Permit's look at the decade 2000-2009, which was a different story:

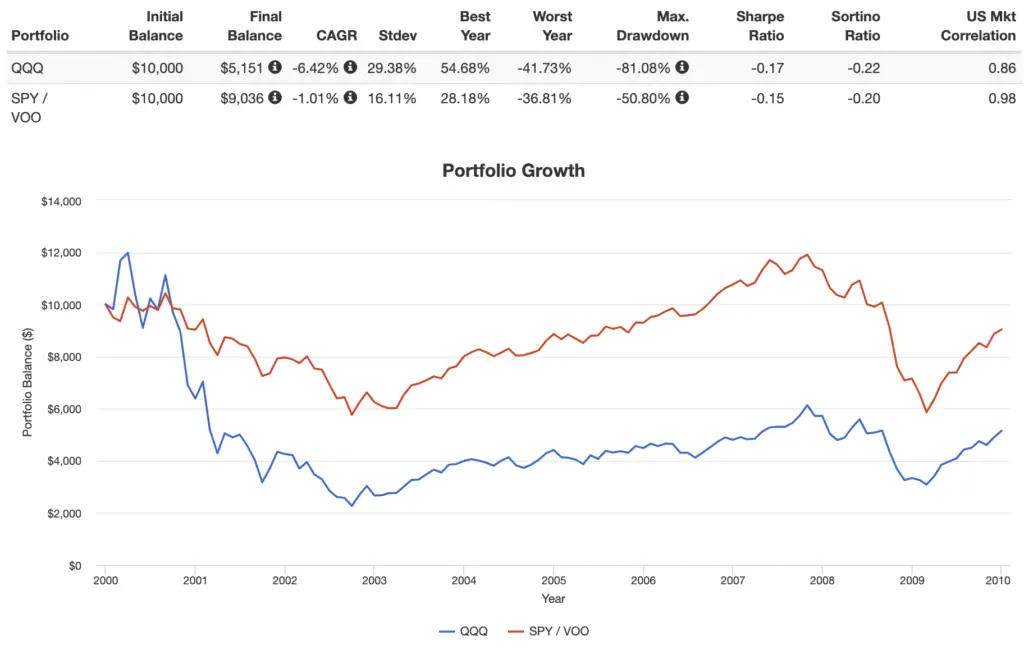

Both funds lost money considering they had to endure ii crashes, but you still would take come up out alee with SPY.

Imagine for a second that this is January, 2010. After the previous decade, the S&P 500 is down by about 10% for that fourth dimension period versus the Nasdaq 100 beingness down nigh 50%. Would yous still be as enthused well-nigh QQQ? Logically, we should bemore willing to purchase when prices are low, but I'd be willing to bet the honest answer to this question for most folks would be "no." A rational investor should want toavoid expensive stocks and purchase inexpensive stocks, but this unfortunately isn't how investors' highly-emotional brains work.

QQQ has beaten SPY historically in terms of operation. Merely don't succumb to recency bias and performance chasing. Past operation does not signal future functioning. More importantly, big cap growth stocks are at present looking extremely expensive relative to history and are at the valuations we saw in 2000 at the height of the tech bubble, meaning they now accept lower future expected returns. To brand things worse, fundamentals of these companies practice not explain these valuations. The situation has simply been an expansion of price multiples.

Value stocks, on the other easily, are looking extremely cheap, significant they now have greater expected returns. Of grade, we await Value to outperform every day when we wake up anyway due to what nosotros retrieve is a take chances factor premium. If y'all purchase QQQ, you won't ain whatsoever Value stocks. QQQ is purely large cap growth stocks, the segment with lower expected returns. You also won't own any small- or mid-cap stocks, which accept outperformed large stocks historically.

The valuation spread betwixt Value and Growth was recently equally big as information technology'southward ever been. Historically, wide value spreads have also reliably preceded massive outperformance by Value. At the end of the day, nosotros're still paying for a discounted sum of all future greenbacks flows; Growth cannot get more than expensive forever.

People like to merits "tech is the future!" That may be truthful, but that doesn't have much to exercise with stock market returns, which are not correlated with Gross domestic product. The economic system is not the stock marketplace, and the stock market is not the economy. Remember that extremely loftier expectations for these tech firms are already priced in, and they volition have to exceed those expectations in guild to beat the marketplace. Moreover, good companies tend to make bad stocks and bad companies tend to brand good stocks.

While I don't use or disregard market timing, we also must acknowledge the fact that nosotros may see rising interest rates sometime in the near hereafter, and QQQ inherently has more than interest rate gamble than SPY. Moreover, QQQ by definition excludes Financials, which tend to do well when involvement rates rise.

As well remember that you don't need a "tech tilt" anyway; the market place is already over 30% tech at this point.

QQQ vs. SPY & VOO – Conclusion

Don't use QQQ as the core of your portfolio. Period. Doing then is purely performance chasing.

Some like to tilt (overweight) with QQQ, but recollect that SPY already has a tech tilt because information technology's market cap weighted. QQQ is already inside SPY and VOO. If the companies in QQQ do well, they volition also rise within SPY, so you already take exposure to their success.

Only fourth dimension will tell which index outperforms. We tin't know the future, but I would argue that's the reason for broad diversification in the first place.

Conveniently, all these funds should be available at any broker, including M1 Finance, which is the 1 I'1000 usually suggesting around here.

What do you lot retrieve of QQQ and SPY? Let me know in the comments.

Disclosure: I own VOO in my ain portfolio.

Disclaimer: While I love diving into investing-related data and playing around with backtests, I am in no style a certified expert. I have no formal fiscal didactics. I am not a financial advisor, portfolio manager, or auditor. This is not fiscal advice, investing communication, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. Information technology is not a recommendation to buy, sell, or otherwise transact in whatsoever of the products mentioned. Practice your ain due diligence. Past performance does not guarantee future returns. Read my lengthier disclaimer hither.

Source: https://www.optimizedportfolio.com/qqq-vs-spy/

Posted by: hartleyhaddespeame.blogspot.com

0 Response to "Is It Better To Emergency Fund Into Money Market Versus Bond Fund"

Post a Comment